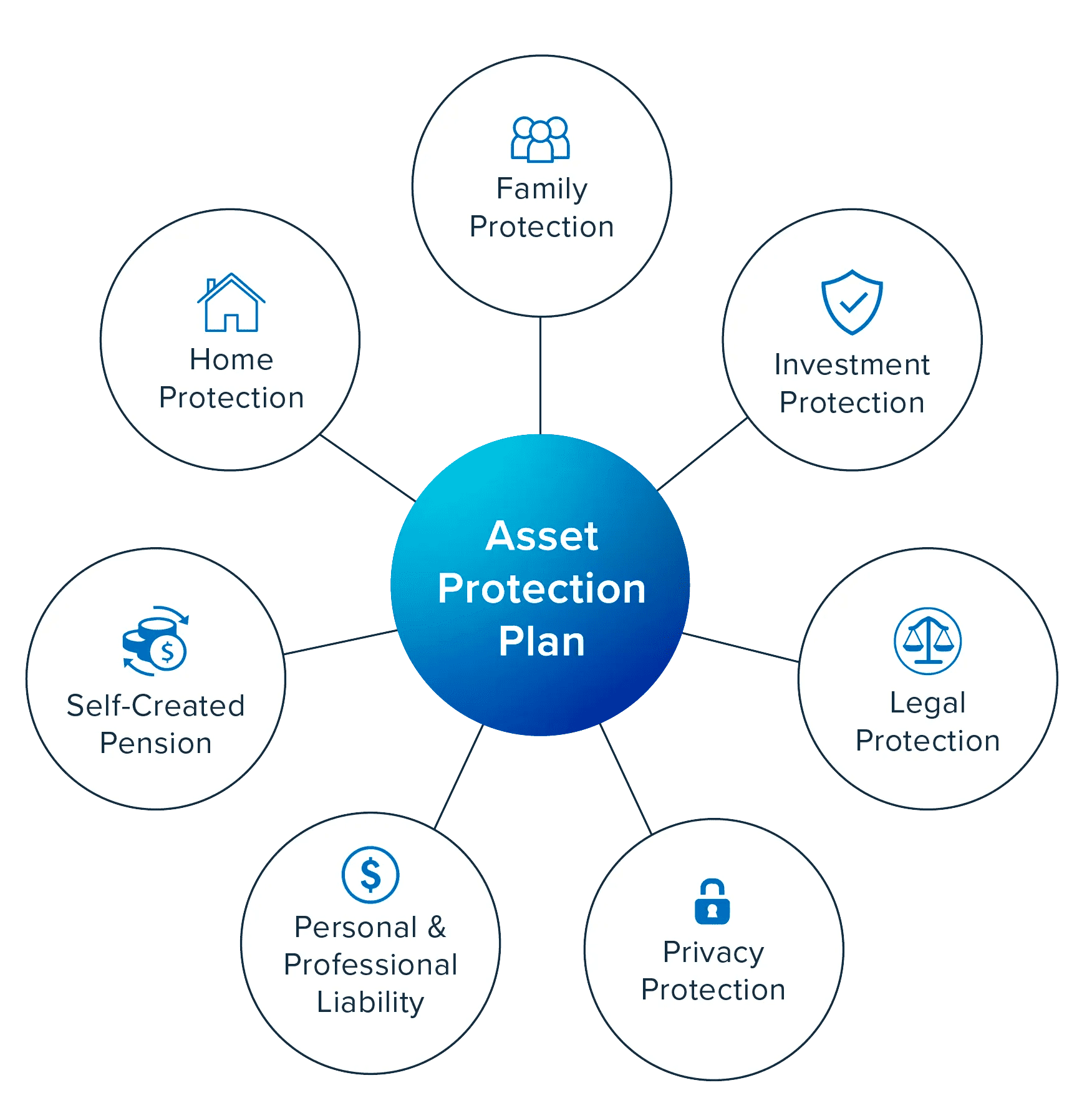

Asset protection planning in retirement involves putting legal measures in place to protect your assets from potential creditors or lawsuits. The goal is to safeguard your retirement savings and investments from financial loss due to factors such as fraud, exploitation, and investment mistakes.

Common asset protection strategies for retirees include creating trusts, setting up limited liability companies, and transferring ownership of assets to family members. Another common strategy is to invest in retirement accounts that are protected by federal or state laws.

No, not all types of retirement accounts are protected from creditors. Accounts that are protected by federal law include 401(k) plans, individual retirement accounts (IRAs), and pensions. Certain state laws may offer some additional protection for retirement accounts as well.

Yes, asset protection planning can be done at any time, including after retirement. However, it’s important to note that some strategies may be less effective if implemented after retirement, so it’s best to plan ahead whenever possible.

Yes, a pension protection plan is a type of trust that can help protect retirement assets from creditors. These plans are available in some states and are designed to shield assets from potential creditors while still providing the retiree with access to their funds.

Yes, ERISA plans, such as 401(k)s and pensions, are protected from creditors. However, ERISA plans are not invincible to creditor claims, such as those related to child support.

Website Powered by WGA Global & Simple SEO Group

Investment Advisory Services offered through Goldstone Financial Group, LLC a Registered Investment Advisor (GFG).

*Guarantees provided by insurance products are backed by the claims paying ability of the issuing carrier.

“The Changing Story of Retirement” report is provided for informational purposes only. It is not intended to provide tax or legal advice. By requesting this report you may be provided with information regarding the purchase of insurance and investment products in the future.

* Goldstone Financial Group utilizes third-party marketing firms to secure media and publication appearances. Features and appearances may be marketing paid for by Goldstone direct to the media channels and publications listed above. The network and publication appearances listed do not represent any endorsement, level of expertise, recommendation, or any affiliation with Goldstone Financial Group.

Goldstone applied and paid an application fee to be considered for the Inc. 5000 Fastest Growing Companies. The award results were independently evaluated and determined by the Inc. 5000 criteria. Additional information regarding the Inc. 5000 program and full eligibility criteria can be found here.

Goldstone pays an annual fee to be part of the BBB Accreditation Program. The ratings/grades given to Goldstone are independently determined and provided by the BBB and their criteria standards. Additional information regarding the BBB and full details of its Accreditation Standards can be found here.

Goldstone was certified as a ‘Great Place to Work’ in March 2023 after a two-step process including anonymous employee surveys and a questionnaire regarding our workforce. A subscription fee was paid by Goldstone to access the survey website, but no fee was paid to receive the certification. Additional information regarding the Best Places to Work Award and the complete eligibility criteria can be found here.

"*" indicates required fields