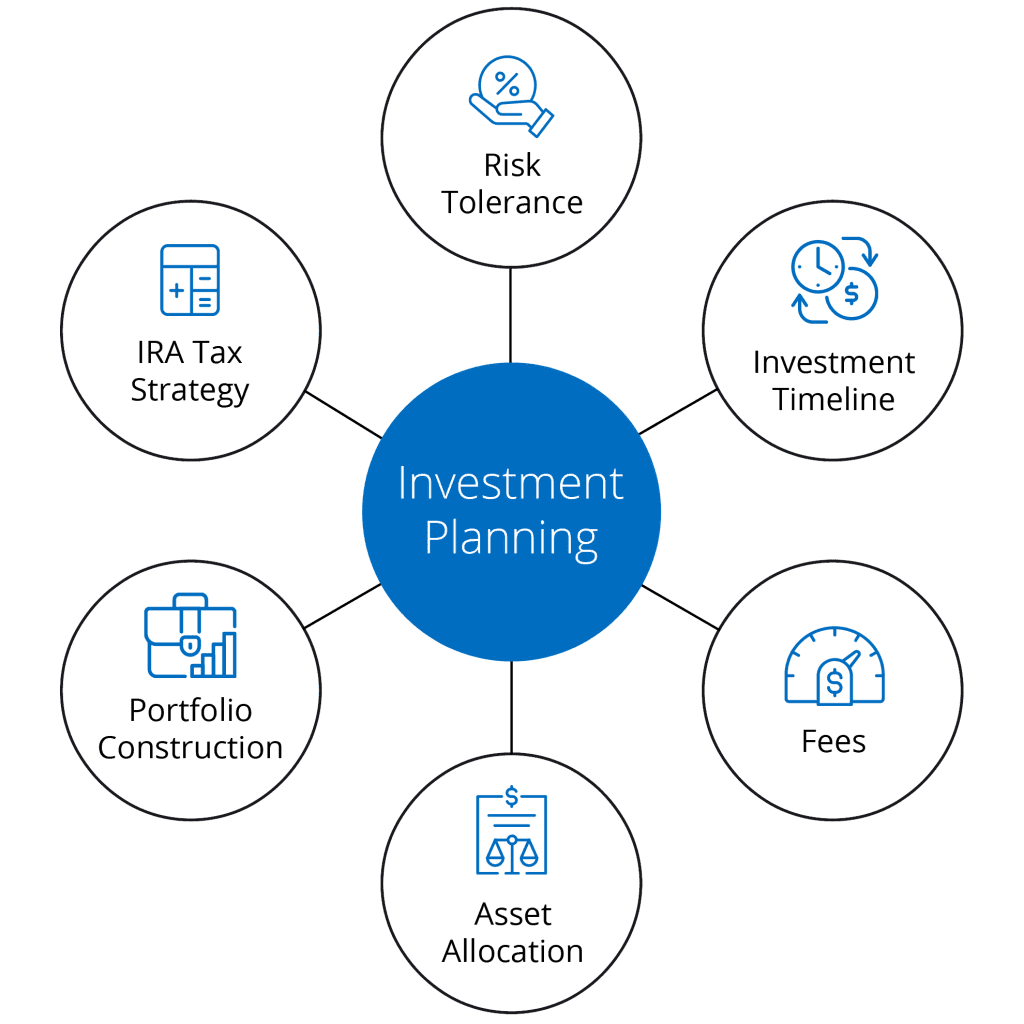

Once you have a investment plan in place, the next step is to develop an investment strategy with a diversified portfolio. A good investment strategy should be based on your long-term goals, risk tolerance, and time horizon. It should also take into account the different asset classes and investment vehicles available.

Asset classes refer to different types of investments, such as stocks, bonds, real estate, and commodities. Each asset class has its own level of risk and return potential, so it’s important to diversify your portfolio across multiple asset classes.

Investments can be managed actively or passively. Active management involves selecting individual stocks and bonds based on market trends and other factors. Passive management, on the other hand, involves investing in index funds or other funds that track a particular market index. Both strategies have their pros and cons, so it’s important to weigh the risks and rewards of each.

A retirement investment account is a type of account that is designed specifically for retirement savings. Some examples of retirement investment accounts include 401(k) plans, traditional IRAs, and Roth IRAs.

An investment strategy is a plan for investing your money in a way that aligns with your financial goals and risk tolerance. A sound investment strategy will typically include a diversified portfolio of investments across different asset classes and investment vehicles.

Asset management refers to the professional management of assets, such as stocks, bonds, and other securities. Asset managers are responsible for making investment decisions on behalf of their clients, with the goal of maximizing returns while minimizing risk.

Goldstone Financial Group is an independent financial advisory firm and fiduciary. As fiduciaries, we have a legal and moral obligation to put your financial interests and needs first. Our team works together to provide you with strategies and solutions that combine all facets of your retirement life. Moreover, we believe in educating our clients, which is why we post a blog article to our website each week and offer complimentary educational guides on a variety of financial topics. You can stay up to date with financial news and gain access to our newest blog and guides by clicking here to sign up to receive our weekly newsletter.

It’s easy! Please give us a call at (630) 620-9300 or request an appointment by clicking here. We will then reach out to you to schedule a time to set up an introductory meeting. This introductory meeting will review your current financial plan and goals. This meeting can be held over the phone or in-person at one our office locations.

Asset allocation refers to the process of dividing your investment portfolio among different asset classes, such as stocks, bonds, and real estate. The goal of asset allocation is to create a diversified portfolio that balances risk and return.

An investment portfolio is a collection of investments, such as stocks, bonds, and mutual funds, that an individual or organization owns. The composition of an investment portfolio will depend on the investor’s financial goals, risk tolerance, and time horizon.

Short-term investments are investments that are typically held for less than one year and are designed to provide liquidity and preserve capital. Long-term investments, on the other hand, are investments that are held for several years or even decades and are designed to provide growth and capital appreciation over time.

Mutual funds and index funds are investment vehicles that allow individuals to invest in a diversified portfolio of stocks, bonds, or other securities. Mutual funds are actively managed by professional portfolio managers, while index funds are passively managed and are designed to track a particular market index, such as the S&P 500.

Website Powered by WGA Global & Simple SEO Group

Investment Advisory Services offered through Goldstone Financial Group, LLC a Registered Investment Advisor (GFG). Advisory services are only offered to clients or prospective clients where GFG and its representatives are properly licensed or exempt from licensure. This website is solely for informational purposes. Past performance is no guarantee of future returns and investing involves risk and possible loss of principal capital. No advice may be rendered by GFG unless a client service agreement is in place. Services will only be provided in states where GFG is registered or may be exempt from registration. Registration does not imply any level of skill or training.

*Guarantees provided by insurance products are backed by the claims paying ability of the issuing carrier.

“The Changing Story of Retirement” report is provided for informational purposes only. It is not intended to provide tax or legal advice. By requesting this report you may be provided with information regarding the purchase of insurance and investment products in the future.

* Goldstone Financial Group utilizes third-party marketing firms to secure media and publication appearances. Features and appearances may be marketing paid for by Goldstone direct to the media channels and publications listed above. The network and publication appearances listed do not represent any endorsement, level of expertise, recommendation, or any affiliation with Goldstone Financial Group.

Goldstone applied and paid an application fee to be considered for the Inc. 5000 Fastest Growing Companies. The award results were independently evaluated and determined by the Inc. 5000 criteria. Additional information regarding the Inc. 5000 program and full eligibility criteria can be found here.

Goldstone pays an annual fee to be part of the BBB Accreditation Program. The ratings/grades given to Goldstone are independently determined and provided by the BBB and their criteria standards. Additional information regarding the BBB and full details of its Accreditation Standards can be found here.

Goldstone was certified as a ‘Great Place to Work’ in March 2023 after a two-step process including anonymous employee surveys and a questionnaire regarding our workforce. A subscription fee was paid by Goldstone to access the survey website, but no fee was paid to receive the certification. Additional information regarding the Best Places to Work Award and the complete eligibility criteria can be found here.

"*" indicates required fields