7 Essential Secrets for a Rewarding Retirement Journey

Retirement is not just about stepping away from the workforce. It is an opportunity to embrace new possibilities, explore personal interests, and live a life that is aligned with your values and passions. The following seven secrets are essential for a rewarding retirement journey: embracing purpose beyond career, nurturing relationships, staying physically and mentally active, defining clear retirement goals, cultivating new and existing interests, preparing emotionally for retirement transitions, and overcoming retirement challenges with resilience.

Secret 1. Embracing Purpose Beyond Career

One of the key secrets to a fulfilling retirement is embracing purpose beyond a career. Many older adults find that retirement gives them the opportunity to pursue goals and passions that they may have set aside during their working years. Whether it’s starting a new business, volunteering for a cause they believe in, or working towards personal milestones, having a sense of purpose can bring fulfillment and meaning to retirement for Americans. It is important to take the time to reflect on what truly matters to you and find ways to incorporate those values into your retirement lifestyle. By embracing purpose beyond a career, you can create a retirement that is personally fulfilling and meaningful.

Secret 2. Nurturing Relationships for a Supportive Retirement Community

Building and maintaining strong relationships is another secret to a fulfilling retirement. Social connections are vital to our overall well-being, and retirement provides an opportunity to deepen existing relationships and forge new ones. Here are a few ways to nurture relationships for a supportive retirement community:

- Stay connected with family and friends through regular communication and visits.

- Join social clubs or community organizations that align with your interests.

- Participate in group activities or hobbies that allow for social interaction.

- Volunteer for causes or organizations that are meaningful to you, providing a sense of purpose and connection.

By investing in relationships and building a supportive retirement community, you can enjoy a fulfilling and socially connected retirement.

Secret 3. Staying Physically and Mentally Active

Staying physically and mentally active is crucial for a fulfilling retirement. Engaging in regular physical activity, such as following an exercise program, can improve overall health and well-being, boost energy levels, and enhance mood. Similarly, keeping the mind active through mental stimulation can help maintain cognitive function and prevent cognitive decline. Here are some tips for staying physically and mentally active in retirement:

- Incorporate regular exercise into your routine, such as walking, swimming, or yoga.

- Engage in activities that challenge the mind, such as puzzles, reading, or learning a new skill.

- Join exercise classes or groups to stay motivated and meet new people.

- Explore hobbies or interests that require mental and physical engagement, such as gardening or painting.

By prioritizing physical and mental health, you can enjoy a vibrant and fulfilling retirement.

Secret 4. Defining Clear Retirement Goals and Objectives

Defining clear retirement goals and objectives is essential for a fulfilling retirement. Having a sense of direction and purpose can help guide your decisions and actions during this phase of life. Here are some steps to help you define your retirement goals:

- Reflect on your values, passions, and priorities to determine what is most important to you in retirement.

- Set specific financial goals and create a retirement savings plan to ensure you have the necessary funds to support your desired lifestyle.

- Consider how you want to spend your time and what activities or experiences you want to prioritize in retirement.

- Seek guidance from a financial advisor or retirement planning professional to ensure your goals are aligned with your financial situation.

By defining clear retirement goals and objectives, you can create a roadmap for a fulfilling and successful retirement.

Secret 5. Cultivating New and Existing Interests

Cultivating new and existing interests is a key secret to a fulfilling retirement. Retirement provides an opportunity to explore hobbies, learn new skills, and pursue passions that may have been put on hold during your working years. Here are a few ways to cultivate new and existing interests in retirement:

- Take up a new hobby or activity that you’ve always wanted to try, such as painting, photography, or playing a musical instrument.

- Join local clubs or groups that cater to your interests, allowing you to connect with like-minded individuals.

- Enroll in classes or workshops to expand your knowledge and skills in areas of interest.

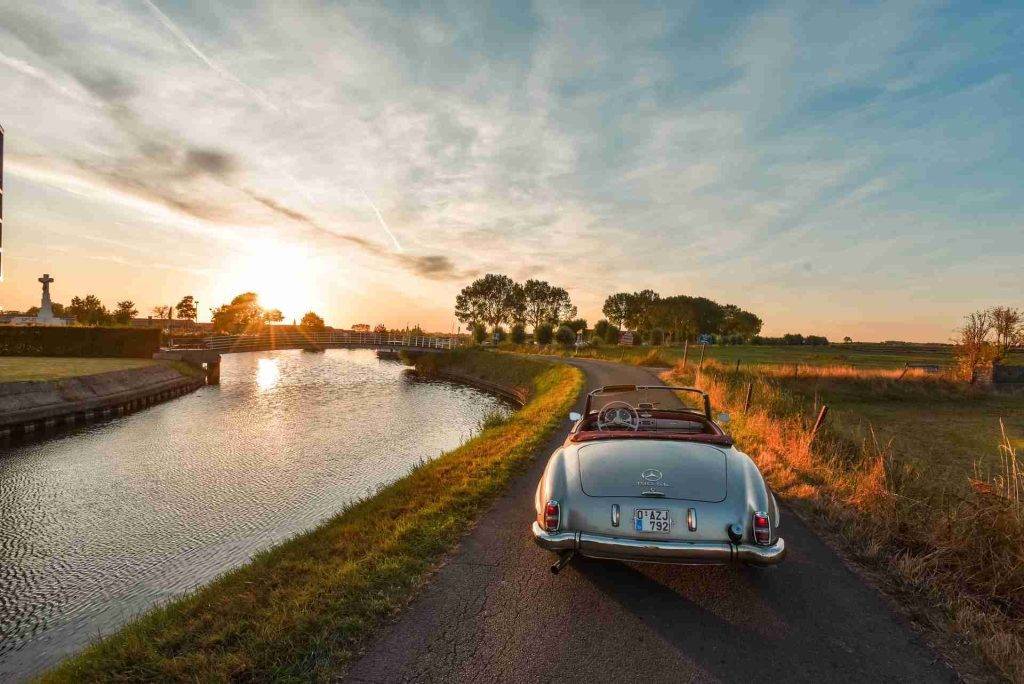

- Travel to destinations that align with your interests, whether it’s exploring nature, visiting historical sites, or experiencing different cultures.

By cultivating new and existing interests, you can find joy and fulfillment in retirement.

Secret 6. Preparing Emotionally for Retirement Transitions

Preparing emotionally for retirement transitions is crucial for a fulfilling retirement. Retirement is a major life change that can bring a mix of emotions, including excitement, uncertainty, and even loss. Here are some strategies to help you navigate these emotional transitions:

- Practice gratitude and mindfulness to cultivate a positive outlook and appreciation for the present moment.

- Engage in activities that promote emotional well-being, such as journaling, meditation, or spending time in nature.

- Seek support from friends, family, or professional counselors to help process any emotional challenges or concerns.

- Embrace new opportunities and challenges with an open mind and a willingness to adapt.

By preparing emotionally for retirement transitions, you can navigate this phase of life with resilience and embrace the possibilities it offers.

Secret 7. Overcoming Retirement Challenges with Resilience

Overcoming retirement challenges with resilience is essential for a fulfilling retirement. Retirement may come with unexpected changes, financial constraints, or health issues. Here are some strategies to help you overcome these challenges:

- Build a strong support network of friends, family, and professionals who can provide guidance and assistance.

- Maintain a positive attitude and a growth mindset, embracing challenges as opportunities for growth and learning.

- Seek professional advice for financial planning and investment strategies to ensure long-term financial security.

- Prioritize self-care and well-being, including regular exercise, healthy eating, and stress management techniques.

By approaching retirement challenges with resilience, you can navigate obstacles and maintain a fulfilling retirement journey.

Frequently Asked Questions

The best activities to stay engaged in retirement vary depending on individual preferences. However, some popular options include physical activities like walking or yoga, social activities like volunteering or joining clubs, and hobbies like gardening or painting.

Finding purpose after retirement involves exploring your passions and interests. Consider volunteering for causes that align with your values or exploring new career paths or entrepreneurial ventures that bring fulfillment and meaning.

Managing retirement anxiety involves implementing stress relief techniques such as relaxation exercises, mindfulness practices, and meditation. Engaging in regular physical activity, maintaining a positive mindset, and seeking support from friends, family, or professionals can also be helpful.

Building a strong social network in retirement involves actively seeking opportunities for social interaction. Joining clubs or organizations, participating in community activities, and staying connected with friends and family can help foster relationships and build a supportive social network.

In conclusion, retirement is a significant life transition that requires thoughtful planning and active engagement. By embracing purpose, nurturing relationships, staying active, setting clear goals, and cultivating interests, you can enhance your retirement experience. It’s essential to prioritize emotional wellbeing by addressing challenges, staying connected through technology, and maintaining a positive outlook. Planning for the unexpected with financial and healthcare considerations is crucial for a fulfilling retirement. Remember, retirement is an opportunity to explore new horizons and enjoy the rewards of your hard work. Embrace this phase with resilience and a proactive mindset for a truly fulfilling retirement journey.