Retirement planning is never static. Market shifts, policy changes, and global economic events continuously reshape the financial landscape. One of the most dramatic shifts in recent years has been the sustained rise in interest rates. After more than a decade of historically low yields, today’s retirees and pre-retirees are facing a very different environment—one where bonds, CDs, and money market accounts offer higher returns, but inflation and volatility remain looming concerns.

So, how can retirees navigate this “upside-down” rate climate in September 2025 and beyond? Let’s break it down.

Understanding the Current Interest Rate Environment

For much of the 2010s and early 2020s, interest rates hovered near record lows. Retirees often had no choice but to pursue riskier investments in search of yield. But as of September 2025, the story looks very different:

Certificates of Deposit (CDs) are yielding between 4% and 5%.

Treasury Bonds and Corporate Bonds have climbed back into historically “normal” ranges.

Money Market Funds are paying higher short-term yields than they have in decades.

On the surface, this may sound like a dream come true for retirees who value safety and stability. But higher rates also come with challenges: bond prices fall when rates rise, borrowing costs increase, and inflation—though cooling—still erodes purchasing power.

The Opportunity for Retirees

Retirees who rely on fixed incomes can actually benefit from a higher-interest environment if they take the right steps. Unlike previous years, safe and conservative instruments like CDs and short-term Treasuries from a credit union are no longer producing negligible returns. This opens up new strategies for generating stable income while reducing exposure to stock market volatility.

Key Opportunities:

Better returns on safe assets – CDs, savings accounts, and money markets are attractive again.

Improved bond income – Higher yields create more reliable income streams.

Diversification potential – With more balance between stocks and fixed income, retirees can reduce volatility without sacrificing returns.

Risks to Watch Out For

A rising-interest environment isn’t without its pitfalls. Retirees should be mindful of:

Bond Price Declines – If you’re holding long-term bonds purchased at lower rates, their market value has likely dropped, though you may eventually receive the face value at maturity.

Inflation Pressure – Even moderate inflation can eat away at real returns if left unchecked.

Sequence of Returns Risk – Retirees drawing income during volatile periods can lock in losses that permanently impact their portfolio.

Over-Concentration in Cash – While higher yields are tempting, parking too much money in low-growth vehicles can hinder long-term sustainability.

Strategies for Navigating Retirement in a Rising-Interest Environment

Rebalance Your Portfolio

If your retirement portfolio was built for a low-rate world, it may be too heavily weighted in equities. Rebalancing toward fixed-income instruments, which generally carry lower risk, can provide steady income without excessive risk.

Shift gradually into higher-yielding bonds and CDs.

Maintain exposure to equities for long-term growth, but trim oversized allocations.

Review allocations annually to account for interest rate and inflation changes.

Lock in Attractive Yields

Today’s yields may not last forever. Retirees can benefit by locking in rates:

Laddering CDs or bonds ensures steady cash flow while capturing higher yields across different maturities.

Annuities can also provide guaranteed income, though terms should be carefully reviewed with a financial advisor.

Treasury Inflation-Protected Securities (TIPS) offer protection against rising prices while providing interest income.

Build a Short-Term Reserve

In times of uncertainty, having liquidity is critical. Retirees should maintain at least 6–12 months of living expenses in high-yield savings or money market funds to understand how much money they may need. This reduces the need to sell investments during downturns and provides peace of mind.

Combat Inflation Risk

Inflation, even when modest, erodes purchasing power over time. Retirees should:

Diversify into real assets like REITs or commodities for partial inflation hedging.

Use TIPS as part of the fixed-income allocation.

Keep a portion of the portfolio in growth equities to outpace inflation long-term.

Consider Tax Efficiency

With higher yields, retirees may see more taxable retirement income from interest payments. Strategies include:

Using municipal bonds for tax-advantaged interest.

Holding fixed-income instruments inside tax-deferred accounts (IRAs, 401(k)s).

Consulting with a tax advisor to optimize withdrawals and minimize tax drag.

The Role of Professional Guidance

Interest rate cycles are complex, and every retiree’s situation is unique. The right mix of safety, growth, and income depends on factors like:

Your time horizon

Risk tolerance

Legacy goals

Health and long-term care considerations

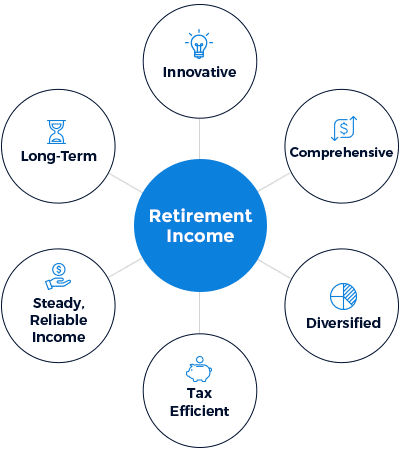

A financial advisor can help you design a personalized income strategy that balances opportunity with protection. At Goldstone Financial Group, our Retirement Roadmap process evaluates your entire financial needs to create strategies that work in today’s environment—and tomorrow’s.

Final Thoughts

After years of record-low interest rates, retirees now face a world of new opportunities—and new challenges. Higher yields offer a chance to secure stable income streams without relying solely on equities, but they also demand careful planning to mitigate inflation risk, tax exposure, and portfolio volatility. When starting your retirement planning, it’s crucial to assess your financial goals, estimate your future expenses, diversify your investment portfolio, understand your tax implications, and factor in potential inflation and market changes to create a resilient strategy.

The takeaway? Adaptation is key. By rebalancing portfolios, locking in attractive rates, and building inflation protection, retirees can thrive in this rising-interest environment.

At Goldstone Financial Group, we specialize in helping retirees and pre-retirees navigate changing market conditions. Our Retirement Roadmap isn’t a one-size-fits-all plan—it’s tailored to your goals, income needs, and lifestyle.

Ready to review your retirement strategy in light of today’s rising-interest environment? Schedule a complimentary consultation with our team today and ensure your nest egg works harder for you.